Credit Acceptance Phone Number: Your Ultimate Guide To Connecting

Table of Contents

- Understanding Credit Acceptance: Who They Are

- Why You Might Need the Credit Acceptance Phone Number

- The Primary Credit Acceptance Phone Number: Your Direct Line

- Beyond the Phone: Alternative Contact Methods

- Tips for a Smooth Call with Credit Acceptance

- Understanding Credit Acceptance's Business Model and Reach

- Responsiveness and Customer Experience

- The Importance of Direct Communication for YMYL Topics

Understanding Credit Acceptance: Who They Are

Credit Acceptance Corporation stands as a significant entity in the subprime auto finance market, primarily focusing on helping consumers with less-than-perfect credit secure vehicle financing. Their business model is designed to assist individuals who might otherwise struggle to obtain traditional auto loans, providing them with the opportunity to purchase a vehicle and, importantly, to rebuild their credit history. As stated in their operational philosophy, "At Credit Acceptance, we’re dedicated to doing everything possible to help you get your customers into a vehicle and keep them coming back." This commitment extends beyond just facilitating loans; it encompasses a broader effort to support both dealers and individual borrowers through their financial journey. Their approach often involves working closely with a network of auto dealerships, offering them tools and programs that allow for high approval rates, sometimes up to 100% of customers, with approvals often granted in 30 seconds or less. This efficiency is a cornerstone of their service, aiming to streamline the car-buying process for those who need it most. For customers, understanding that Credit Acceptance operates with this specific focus can help frame expectations when seeking assistance or information, particularly when reaching out via the Credit Acceptance phone number or other channels. They are not just a lender; they are a facilitator for vehicle ownership in a specific market segment, emphasizing accessibility and quick decisions. Their expertise in this niche allows them to offer tailored solutions, making them a crucial resource for many individuals.Why You Might Need the Credit Acceptance Phone Number

There are numerous reasons why you might find yourself needing to contact Credit Acceptance, and often, the most efficient method is directly through their customer service line. Whether you're a current borrower managing an existing loan or a potential customer with pre-qualification questions, the Credit Acceptance phone number serves as a vital conduit for information and support. Common scenarios that necessitate a phone call include: * **Payment Inquiries:** You might need to "learn how to pay your Credit Acceptance bill online, by phone, or in person," or perhaps clarify a payment due date or amount. Sometimes, unexpected financial situations arise, and you might need to discuss payment arrangements or report a payment issue. * **Account Management:** This could involve updating your personal information, such as a change of address or phone number, or discussing options for managing alerts and notifications related to your account. "Find answers to commonly asked questions about payments, managing alerts, and more" often starts with a direct conversation. * **Requesting a Payoff Quote:** If you're looking to pay off your loan early, refinance, or sell your vehicle, you'll need an accurate payoff quote. The most reliable way to "request a payoff quote by phone" ensures you receive the most current and precise figures. * **General Questions and Support:** From understanding the terms of your loan to clarifying specific charges, a direct conversation can often resolve queries much faster than other methods. "Contact us to ask a question, make a complaint, or any other general correspondence" is a key function of their phone support. * **Technical Support for Online Services:** While Credit Acceptance offers robust online portals, occasional technical glitches or navigation issues can arise. A phone call can provide immediate assistance if you're experiencing difficulties accessing your online account, especially during periods like "Credit Acceptance's website & customer portal are undergoing system maintenance on Saturday, February 5th 2022 from 01:." In essence, for any matter requiring immediate attention, personalized guidance, or the discussion of sensitive financial details, leveraging the Credit Acceptance phone number is typically the most effective course of action.The Primary Credit Acceptance Phone Number: Your Direct Line

When it comes to getting in touch with Credit Acceptance, the company itself states, "The best way to contact us is by phone or chat, but we can also be reached by mail." This highlights the importance and efficiency of direct verbal communication for most customer needs. While specific phone numbers can sometimes change or vary based on the department you need, the primary customer service line is designed to be your initial point of contact for a wide array of inquiries. To "find the phone number for Credit Acceptance customer service and get tips for managing your account," the most reliable first step is always to check their official website, www.creditacceptance.com. Their website is the definitive source for the most current contact details, ensuring you dial the correct Credit Acceptance phone number for your specific needs. Having a direct line to customer support is invaluable, particularly for financial matters that require detailed discussion or immediate resolution. The phone allows for real-time interaction, enabling you to ask follow-up questions, clarify complex information, and receive personalized assistance that might not be as readily available through other channels. This directness is especially beneficial when dealing with sensitive topics like payment issues, loan adjustments, or requesting a payoff quote, where nuances of your situation can be better conveyed and understood through conversation. Always ensure you are calling the official number listed on their website to protect your financial information and ensure you reach the legitimate Credit Acceptance customer service team.Navigating Customer Service Hours

Before you dial the Credit Acceptance phone number, it's crucial to be aware of their operating hours to ensure your call is answered promptly. According to their stated availability, "Operation hours are Monday to Saturday, except for Sunday." This means that you have a six-day window each week to reach their customer service team. Planning your call within these hours can significantly reduce wait times and improve your overall experience. Understanding these hours is vital for several reasons. Firstly, it helps you avoid the frustration of calling outside of business hours and encountering an automated message. Secondly, it allows you to schedule your call at a time when you are most likely to receive comprehensive support. For instance, calling during peak times (like Monday mornings or just after opening) might result in longer hold times, whereas mid-week or mid-day calls could potentially offer quicker access to a representative. Always factor in these operational hours when planning to "get in touch with us at Credit Acceptance" to maximize the efficiency of your interaction and ensure you connect with a live agent who can assist with your specific inquiry.Beyond the Phone: Alternative Contact Methods

While the Credit Acceptance phone number is often the most direct route, the company provides several other convenient ways to connect, catering to different preferences and types of inquiries. Understanding these alternatives can help you choose the best method for your specific needs, whether it's for general correspondence, document submission, or self-service account management. "Find various ways to contact us here," Credit Acceptance encourages, ensuring comprehensive support for their customers.Email and Mail Options

For inquiries that are less urgent, require documentation, or simply prefer written communication, Credit Acceptance offers email and traditional mail options. "Find out how to contact Credit Acceptance by phone, email, or mail for auto loans and related financial products." While an immediate email address for customer service isn't explicitly provided in the data, companies typically offer contact forms on their website or specific email addresses for general inquiries. For formal correspondence, complaints, or sending physical documents, mail remains a reliable method. Their corporate headquarters address is publicly available: "Credit Acceptance Corporation, 25505 W 12 Mile Rd Southfield, MI 48034." This is also confirmed by "Credit Acceptance’s headquarters are located at 25505 W 12 Mile Rd, Southfield, Michigan, 48034, United States." Sending mail to this address is appropriate for formal letters, legal notices, or situations where a paper trail is essential. Remember that mail can take longer for a response compared to a phone call or online chat, so it's best reserved for non-urgent matters. When you "contact us to ask a question, make a complaint, or any other general correspondence" via mail, ensure all necessary account details are included to facilitate a prompt and accurate response.Online Portals and Self-Service

In today's digital age, online self-service options are increasingly popular for their convenience and accessibility. Credit Acceptance provides robust online tools that empower customers to manage their accounts independently, often reducing the need for a direct phone call. "Learn how to make your car payment online, by mail, in person, or by phone," indicating their commitment to flexible payment solutions. Their website, www.creditacceptance.com, serves as the central hub for these digital services. Through the customer portal, you can often "find answers and helpful information here" to commonly asked questions, ranging from payment schedules to account alerts. This online resource is designed to be a comprehensive FAQ section, allowing you to quickly resolve minor issues without waiting for a representative. Furthermore, "Credit Acceptance offers a secure online prequalification process" for new customers, streamlining the initial application phase. For existing customers, the portal allows for secure online payments and access to account statements. When prequalifying, "from there, you’ll need to enter some basic information, including your name, phone number, email address, date of birth, income, and employment information," highlighting the secure and structured nature of their online interactions. While occasional maintenance periods, such as "Credit Acceptance's website & customer portal are undergoing system maintenance on Saturday, February 5th 2022 from 01:," can temporarily affect access, these online tools generally offer a highly efficient way to manage your auto loan account.Tips for a Smooth Call with Credit Acceptance

To ensure your call to the Credit Acceptance phone number is as productive and efficient as possible, preparation is key. A little foresight can save you time and frustration, leading to a quicker resolution of your inquiry. Here are some tips for a smooth interaction: * **Gather Your Information:** Before you dial, have your account number readily available. This is usually the first piece of information a representative will ask for to verify your identity and access your account details. If you're a new applicant, have your personal information (name, address, date of birth, income, employment details) at hand. * **Be Clear About Your Purpose:** Know exactly why you are calling. Whether it's to "request a payoff quote by phone," inquire about a payment, or make a complaint, having a clear objective will help the representative direct you to the right department or provide the most accurate information. * **Prepare Your Questions:** If you have multiple questions, write them down. This ensures you don't forget anything important during the conversation. * **Take Notes:** During the call, jot down the name of the representative you speak with, the date and time of the call, and any key information or instructions provided. This creates a record of your interaction, which can be useful for future reference or if further follow-up is needed. * **Be Patient and Polite:** Customer service representatives handle numerous calls daily. Maintaining a respectful and patient demeanor, even if you're feeling frustrated, can significantly improve the quality of assistance you receive. * **Confirm Understanding:** Before ending the call, summarize what you've discussed and confirm your understanding of the next steps or resolutions. This ensures there are no misunderstandings and that you have all the information you need. By following these simple guidelines, your experience with the Credit Acceptance phone number will likely be more streamlined and satisfactory, leading to effective resolution of your auto loan inquiries.Understanding Credit Acceptance's Business Model and Reach

Beyond direct customer service, understanding Credit Acceptance's broader operational scope provides insight into their role in the auto finance industry. Their business model is highly focused on empowering auto dealers to serve a wider customer base, particularly those with credit challenges. "Credit Acceptance has the expertise and commitment to provide you with tools to help you grow your business, such as Ability to approve up to 100% of your customers, Approvals in 30 seconds or less." This demonstrates their streamlined approach to loan approvals, which benefits both dealers and the end consumer by making vehicle ownership more accessible. The company's operational footprint is substantial. "Credit Acceptance Corporation has 11 locations," indicating a distributed presence that supports their network of dealers and customers across various regions. While specific details of these locations aren't always public for customer inquiries (as the primary contact is usually centralized), this multi-location structure underscores their capacity and reach within the market. Furthermore, the depth of their internal organization is reflected in data like "On Buzzfile's professional (subscription) service we have 1478 contacts for Credit Acceptance Corporation, including 1029 contacts with email addresses." This suggests a robust internal structure with a large number of professionals dedicated to various aspects of their operations, from finance to dealer relations. Individuals like "Roberts is the primary contact at Credit Acceptance Corp" further highlight the structured nature of their business relationships and internal management. This extensive internal network and operational spread contribute to their ability to manage a large volume of auto loans and provide support, both to their dealer partners and, by extension, to the individual borrowers who utilize their services.Responsiveness and Customer Experience

The effectiveness of any financial institution is often measured by its responsiveness and the overall customer experience it provides. For Credit Acceptance, this translates into how efficiently they handle inquiries made through the Credit Acceptance phone number, online portals, or mail. While the provided data points to the company's internal structure and commitment, external responsiveness is key for customer satisfaction. "See the company's responsiveness rating, executive contacts, and frequently asked questions" suggests that transparency about their service levels is a priority, or at least a metric they track. A company's responsiveness directly impacts a customer's trust and confidence, especially in "Your Money or Your Life" (YMYL) contexts like auto loans. When customers need to "find answers and helpful information here," prompt and accurate responses are critical. This includes how quickly calls are answered, how thoroughly questions are addressed, and how effectively issues are resolved. While specific responsiveness ratings are not provided in the data, the emphasis on direct contact via phone and comprehensive online FAQs indicates an effort to be accessible. For financial products, clear, consistent, and timely communication builds trust and reinforces the company's authority and expertise in its field.Addressing Common Queries: Payments and Account Management

A significant portion of customer interactions with Credit Acceptance revolves around payments and general account management. The company anticipates these needs by providing multiple avenues for resolution. "Learn how to make your car payment online, by mail, in person, or by phone" highlights their commitment to offering flexible payment solutions, acknowledging that customers have diverse preferences and circumstances. This flexibility is crucial for maintaining good standing on an auto loan. Beyond making payments, customers frequently seek information on their account status, upcoming due dates, or managing alerts. "Find answers to commonly asked questions about payments, managing alerts, and more" is a core function of their customer support resources, whether accessed through the Credit Acceptance phone number or their online portal. The goal is to empower customers with the information they need to effectively manage their financial obligations. Furthermore, the directive to "find the phone number for Credit Acceptance customer service and get tips for managing your account" underscores their intention to provide direct assistance for these common yet critical aspects of the customer journey. By proactively addressing these frequent queries through various channels, Credit Acceptance aims to reduce customer friction and enhance the overall loan management experience.The Importance of Direct Communication for YMYL Topics

In the realm of "Your Money or Your Life" (YMYL) topics, such as auto loans and financial products, the ability to engage in direct and reliable communication, particularly through a dedicated Credit Acceptance phone number, is not just a convenience—it's a necessity. Financial decisions carry significant weight and can have profound impacts on an individual's well-being. Therefore, the principles of E-E-A-T (Expertise, Experience, Authoritativeness, and Trustworthiness) are paramount. When you contact Credit Acceptance by phone, you are engaging directly with their expertise. Representatives are trained to provide accurate information regarding your loan, payment options, and any specific concerns you may have. This direct access allows for a nuanced discussion of your financial situation, which is often difficult to achieve through automated systems or email correspondence alone. The ability to ask follow-up questions in real-time and receive immediate clarification builds confidence in the information provided. Furthermore, a well-managed phone support system contributes significantly to the company's authoritativeness and trustworthiness. Knowing that you can reach a human being who can provide definitive answers to complex financial questions instills a sense of security. For instance, when you "request a payoff quote by phone," you are receiving an authoritative figure directly from the source, which is critical for making informed financial decisions like refinancing or selling your vehicle. This direct line of communication helps "understand how Credit Acceptance Corp fits into your total" financial picture, allowing for comprehensive planning. In a world where financial scams and misinformation are prevalent, the reliability of a direct phone number and the human interaction it provides serves as a crucial safeguard, reinforcing the legitimate and trustworthy nature of the financial institution. This direct engagement is fundamental for ensuring that customers receive the accurate, timely, and personalized information they need to manage their financial health effectively.Conclusion

Connecting with Credit Acceptance, particularly through their dedicated phone number, is a straightforward process designed to support you through your auto loan journey. As we've explored, whether you need to manage payments, request a payoff quote, or simply have a general inquiry, the Credit Acceptance phone number serves as your primary and most direct line to their customer service team. Remember to check their official website for the most current contact details and operating hours, which typically run Monday to Saturday. Beyond the phone, Credit Acceptance offers various alternative contact methods, including online portals for self-service and mail for formal correspondence, providing flexibility to suit your communication preferences. By preparing for your calls and utilizing the available resources, you can ensure a smooth and efficient interaction. In the critical domain of financial services, clear and accessible communication channels, especially direct phone support, are vital for building trust and ensuring you receive the expert guidance needed to manage your auto loan effectively. We hope this guide has provided you with valuable insights into contacting Credit Acceptance. If you found this information helpful, please consider sharing it with others who might benefit. Do you have any experiences or tips for contacting Credit Acceptance? Share them in the comments below! For more comprehensive guides on managing your finances and understanding loan processes, explore other articles on our site.

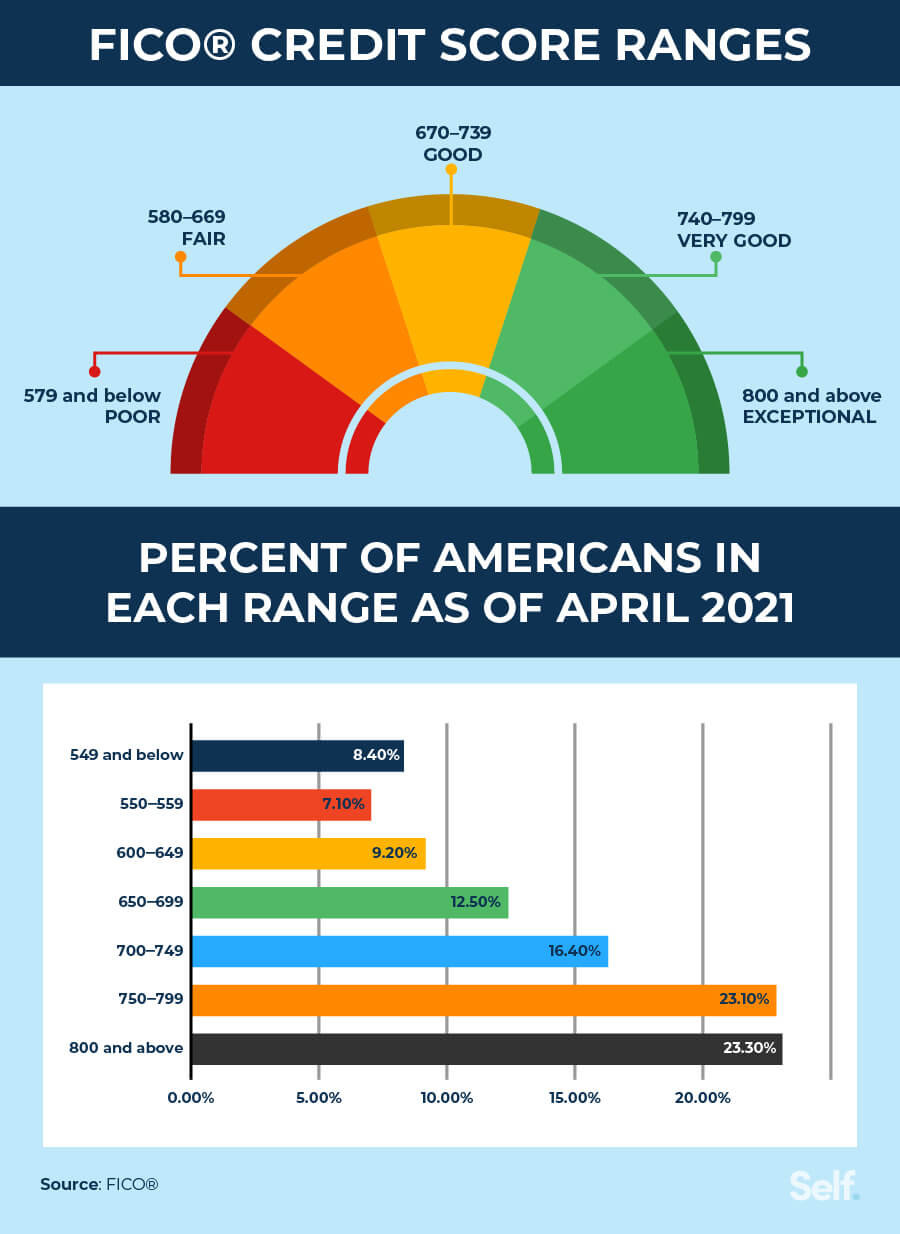

What is good credit score? Leia aqui: What is a good credit score by

What Does a 600 Credit Score Mean? Understanding Your Rating

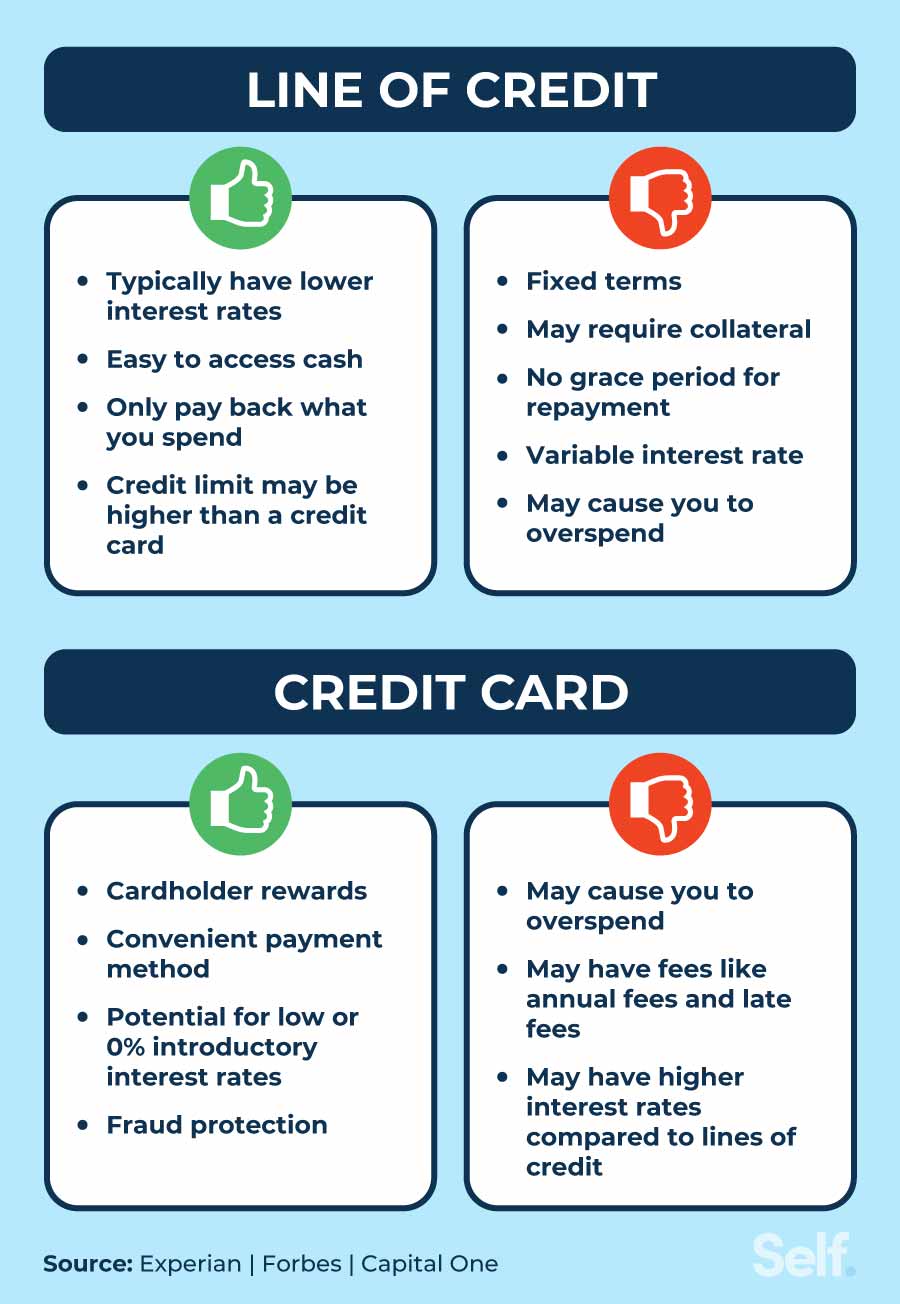

Line of Credit vs. Credit Card: The Key Differences - Self. Credit Builder.