Credit Strong: Boost Your Credit & Savings – A Full Guide

Navigating the world of personal finance can often feel like walking through a maze, especially when it comes to building or rebuilding your credit score. A strong credit profile is not just a number; it's a gateway to better financial opportunities, from securing a loan for a home or car to even influencing insurance rates and rental applications. For many, the challenge lies in getting started, particularly if they have a limited credit history or past financial missteps. This is where solutions like Credit Strong come into play, offering a structured path to improve your credit score while simultaneously building your savings.

This comprehensive guide will dive deep into Credit Strong, exploring its unique approach to credit building. We'll break down how their products work, what they cost, and crucially, how they stack up against other options available in the market. Our aim is to provide you with all the essential information needed to make an informed decision about whether Credit Strong is the right tool for your financial journey, ensuring you understand every facet of their offerings.

Table of Contents

- Understanding Credit Strong: What Is It?

- How Credit Strong Works: The Mechanics of Credit Building

- Credit Strong's Product Offerings: Tailored Solutions

- Requirements and Eligibility for Credit Strong

- Pricing and Costs: An Honest Look at Credit Strong

- Benefits and Potential Downsides of Using Credit Strong

- Credit Strong Alternatives: Other Options to Consider

- Maximizing Your Credit Strong Experience

Understanding Credit Strong: What Is It?

Credit Strong is essentially a credit building app that offers secured loans and savings accounts designed to help individuals improve their credit score. It operates on a principle that might seem counter-intuitive at first glance: you take out a loan, but you don't actually receive the money upfront. Instead, the loan amount is held in a locked savings account, and your regular payments towards this "loan" are reported to the major credit bureaus. This unique mechanism allows you to demonstrate responsible financial behavior, which is a cornerstone of a healthy credit profile.

The core idea behind Credit Strong is to provide a structured way for people to establish a positive payment history, which is the most significant factor in calculating a credit score. Unlike traditional loans where you receive funds and then repay them, Credit Strong's model ensures that the money you "borrow" is essentially your own savings, held securely until the loan term is complete. This mitigates risk for both the user and the lender, making it an accessible option for those who might not qualify for unsecured credit products.

The company emphasizes transparency and simplicity, aiming to make the complex process of credit building more manageable for everyday users. They offer various products to help you improve your credit score and build your savings, making it a dual-purpose financial tool.

How Credit Strong Works: The Mechanics of Credit Building

Understanding the operational mechanics of Credit Strong is crucial to appreciating its value. It's not a typical loan, nor is it a simple savings account. It's a hybrid designed specifically for credit improvement. Learn how they work, how much they cost, and what other options are available.

The Secured Loan Model

At its heart, Credit Strong utilizes a secured installment loan model. When you sign up for a Credit Strong account, you're approved for a loan, but the funds from this loan are immediately placed into a locked savings account in your name. You do not receive these funds until the loan is fully paid off.

- Initial Credit Limit: For many of their products, you might start with an initial credit limit of $1,000 of revolving credit, though this can vary based on the specific product chosen.

- Payment Reporting: Each month, you make a fixed payment towards this loan. Credit Strong reports these payments to all three major credit bureaus (Experian, Equifax, and TransUnion). Consistent, on-time payments are the most powerful way to build a positive credit history.

- Credit Limit Bumps: As you demonstrate responsible payment behavior, some accounts may offer credit limit bumps of $150, potentially increasing your maximum credit limit up to $2,500. This shows creditors that you can handle higher amounts of credit responsibly, further boosting your credit profile.

This continuous reporting of positive payment history is what directly impacts your credit score over time. It demonstrates to potential lenders that you are a reliable borrower, capable of managing debt responsibly.

Building Savings Simultaneously

One of the most appealing features of Credit Strong is its dual benefit: while you're building credit, you're also building savings. This is a significant differentiator from other credit-building methods, like secured credit cards, where your deposit is simply collateral.

- Savings Accumulation: A remarkable feature is that 100% of every monthly payment builds your savings (0% APR on the savings portion). This means that every dollar you pay towards your Credit Strong loan, minus any interest or fees, goes directly into your locked savings account.

- Access to Funds: Once the loan term is complete and you've made all your payments, the full amount accumulated in your savings account is released to you. This provides a lump sum of savings that you might not have accumulated otherwise.

- Annual Percentage Yields (APY): It's worth noting that annual percentage yields (APY) are accurate as of 1/5/2025 and may change after account opening. While the primary goal is credit building, the savings component offers an additional financial benefit.

This integrated approach helps users cultivate a savings habit alongside responsible credit management, making it a holistic tool for financial improvement.

Credit Strong's Product Offerings: Tailored Solutions

Credit Strong offers four products to help you improve your credit score, each designed to cater to different needs and financial situations. Understanding these distinct offerings is key to choosing the right path for your credit building journey. Learn about the different loan options, requirements, pricing, and benefits of Credit Strong.

Core Credit Builder Loans

The primary offerings from Credit Strong revolve around their secured installment loans. These are the backbone of their service, designed for adults looking to establish or improve their credit history.

- Varied Loan Amounts and Terms: While the specifics can vary, these loans typically come with different payment plans and terms, allowing users to choose an option that fits their budget. For instance, some plans might offer an initial credit limit of $1,000 of revolving credit, with potential for increases.

- Flexible Payments: To accelerate savings growth, you might select an account with a monthly payment that is about half as much as you want to pay, and then pay 2x the minimum required monthly payment each month. This strategy allows you to complete the loan faster and access your savings sooner, while still benefiting from consistent credit reporting.

- Focus on Credit Reporting: The main benefit of these loans is the consistent reporting of on-time payments to all major credit bureaus. This builds a positive payment history, which is the most influential factor in credit scoring models.

Learn about the credit builder loans offered, features, fees, and compare it to other options. It's important to review the specific terms and conditions of each loan product to ensure it aligns with your financial goals and capacity.

Freekick: Credit Building for Teens

A standout and particularly innovative product offered by Credit Strong is Freekick. This product is a great way for teens to learn about credit management and establish a strong credit foundation early in life.

- Designed for Young Adults: Freekick is a credit builder account designed specifically for teens, typically those aged 14-17, with a parent or guardian as a co-signer. This unique offering addresses a significant gap in financial literacy and access for younger individuals.

- Early Credit Establishment: By allowing teens to start building a credit history responsibly, Freekick provides a significant head start. When they turn 18, they will already have a foundational credit profile, which can be immensely beneficial for future financial endeavors like student loans, car loans, or even renting an apartment.

- Financial Education: Beyond just building credit, Freekick serves as a practical tool for financial education. It teaches teens about the importance of on-time payments, the concept of credit, and how responsible financial behavior impacts their future.

- Savings Component: Similar to the adult credit builder loans, Freekick also incorporates a savings component. Only six tiers of balances are accepted for Freekick accounts, ensuring a structured approach to savings for young users.

This initiative by Credit Strong is commendable for fostering financial responsibility from a young age, preparing the next generation for sound money management.

Requirements and Eligibility for Credit Strong

Like all financial institutions, Credit Strong has specific requirements for opening an account. These are not just arbitrary rules but are in place for security and regulatory compliance.

To help the government fight the funding of terrorism and money laundering activities, and the theft of your identity, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. This means you will typically need to provide:

- Proof of Identity: A valid government-issued ID (e.g., driver's license, state ID).

- Social Security Number (SSN): Essential for reporting to credit bureaus and identity verification.

- Bank Account Information: For setting up automatic payments.

- Age Requirement: Generally, you must be at least 18 years old for the core credit builder products. For Freekick, a teen (typically 14-17) needs a co-signing parent or guardian.

- Residency: You must be a U.S. resident.

Credit Strong aims to be accessible, so they generally do not require a credit check for approval, making it a viable option for those with poor or no credit history. This is a significant advantage for individuals who are often turned away by traditional lenders.

Pricing and Costs: An Honest Look at Credit Strong

While Credit Strong offers a valuable service, it's crucial to understand its cost structure. Credit Strong offers four products to help you improve your credit score, but they are pricey compared to other options. Learn how they work, what they cost, and what alternatives you can consider.

The cost of Credit Strong comes in the form of interest on the loan and potentially administrative fees. Since the money is held in a secured account, you're essentially paying for the service of having your payments reported to credit bureaus and for the convenience of building savings simultaneously.

- Interest Rates: The Annual Percentage Rate (APR) on the loan portion is where the primary cost lies. While 100% of your monthly payment builds your savings (0% APR on the savings), the loan itself does incur interest. This interest is the fee you pay for the credit reporting service.

- Administrative Fees: Some plans might have an initial administrative fee or a small monthly fee in addition to the interest. It's important to carefully review the terms of the specific product you choose.

- Comparison to Alternatives: When evaluating the cost, it's important to compare it to other credit-building methods. For example, a secured credit card might require a deposit but may have lower annual fees or interest rates if paid off monthly. The "pricey" aspect often refers to the total interest paid over the loan term compared to the principal amount. However, the value comes from the guaranteed savings component and the structured approach to credit building.

Always calculate the total cost of the loan, including all interest and fees, to determine if it aligns with your budget and financial goals. The benefit of improved credit and accumulated savings might outweigh the cost for many, but personal financial situations vary.

Benefits and Potential Downsides of Using Credit Strong

Like any financial product, Credit Strong comes with its own set of advantages and disadvantages. A balanced perspective is essential for making an informed decision.

Benefits:

- Dual Benefit (Credit & Savings): This is arguably the biggest selling point. You build a positive credit history while simultaneously accumulating savings, providing a tangible asset at the end of the term.

- Accessibility: Credit Strong is accessible to individuals with poor or no credit history, as it typically doesn't require a credit check for approval.

- Automatic Reporting: Payments are automatically reported to all three major credit bureaus, ensuring your responsible behavior is recognized.

- Structured Approach: The fixed monthly payments and set loan terms provide a clear, disciplined path to credit improvement.

- Freekick for Teens: The unique offering for teens is a significant advantage for families looking to instill early financial literacy and credit responsibility.

- No Upfront Deposit (for the loan): Unlike secured credit cards, you don't need to put down a large cash deposit to get started with the loan itself, though you are essentially building your own deposit through payments.

Potential Downsides:

- Cost: As mentioned, Credit Strong can be pricey compared to some other credit-building options due to the interest rates on the secured loan.

- Funds are Locked: The savings you accumulate are locked away until the loan term is complete. This means you can't access those funds in an emergency.

- Credit Profile Improvement is Not Guaranteed: While Credit Strong reports your payments, changes in your credit score reflect individually specific financial behavior and history. Other factors, like existing debt, payment history on other accounts, and credit utilization, also play a role. Using Credit Strong responsibly is a strong step, but it's not a magic bullet.

- Longer Term Commitment: Some loan terms can be quite long, requiring a sustained commitment to payments.

It's vital to weigh these pros and cons against your personal financial situation and goals. For someone struggling to build credit and save, the benefits might far outweigh the costs and limitations.

Credit Strong Alternatives: Other Options to Consider

While Credit Strong offers a unique solution, it's not the only path to building or rebuilding credit. Understanding alternatives can help you make the best choice for your circumstances. Learn how it works, what it costs, and how it compares to other options.

- Secured Credit Cards: These require an upfront cash deposit, which typically becomes your credit limit. Your payments are reported to credit bureaus. They can be a good option if you have the upfront cash and want a revolving line of credit. The interest rates can sometimes be lower than credit builder loans if you pay off your balance in full each month.

- Credit Builder Loans (from other institutions): Many credit unions and community banks offer similar credit builder loans. It's worth comparing their interest rates, fees, and terms to Credit Strong's offerings. Some might be less pricey.

- Becoming an Authorized User: If a trusted family member with excellent credit adds you as an authorized user on their credit card, their positive payment history can reflect on your credit report. This is a passive way to build credit, but you have no control over the account.

- Experian Boost: This free service allows you to add positive payment history from utility bills, Netflix subscriptions, and phone bills to your Experian credit report. While it only impacts Experian, it can provide an immediate boost for some.

- Self-Reporting Rent Payments: Services exist that allow you to report your on-time rent payments to credit bureaus, which can positively impact your score.

Each alternative has its own set of advantages and disadvantages regarding cost, impact, and accessibility. Researching and comparing these options is a crucial step in your credit-building journey.

Maximizing Your Credit Strong Experience

If you decide that Credit Strong is the right fit for you, there are strategies you can employ to get the most out of the service and accelerate your credit-building efforts.

- Make On-Time Payments: This is paramount. Consistency is key. Every single on-time payment reported to the credit bureaus strengthens your credit history. Set up automatic payments to avoid missing due dates.

- Consider Accelerating Payments: If your budget allows, consider the strategy mentioned earlier: select an account with a monthly payment that is about half as much as you want to pay, and pay 2x the minimum required monthly payment each month. This helps you complete the loan faster, access your savings sooner, and still benefits your credit profile.

- Monitor Your Credit Report: Regularly check your credit report from all three bureaus (you can get a free report annually from AnnualCreditReport.com). Look for any inaccuracies and monitor your score's progress. Remember, credit profile improvement is not guaranteed solely by using Credit Strong; changes in your credit score reflect individually specific financial behavior and history across all your accounts.

- Maintain Other Good Financial Habits: Credit Strong is a tool, not the entire solution. Continue to manage any other existing debts responsibly, keep credit utilization low on other revolving accounts, and avoid opening too many new credit lines simultaneously.

- Understand Your Account Details: Pay close attention to your annual percentage yields (APY) on savings, accurate as of 1/5/2025 and subject to change. Also, be aware of any fees or specific terms related to your chosen product, including the initial credit limit of $1,000 of revolving credit and the potential max credit limit of $2,500 with credit limit bumps of $150.

By actively engaging with your Credit Strong account and maintaining overall financial discipline, you can significantly enhance its effectiveness in building a robust credit foundation.

Conclusion

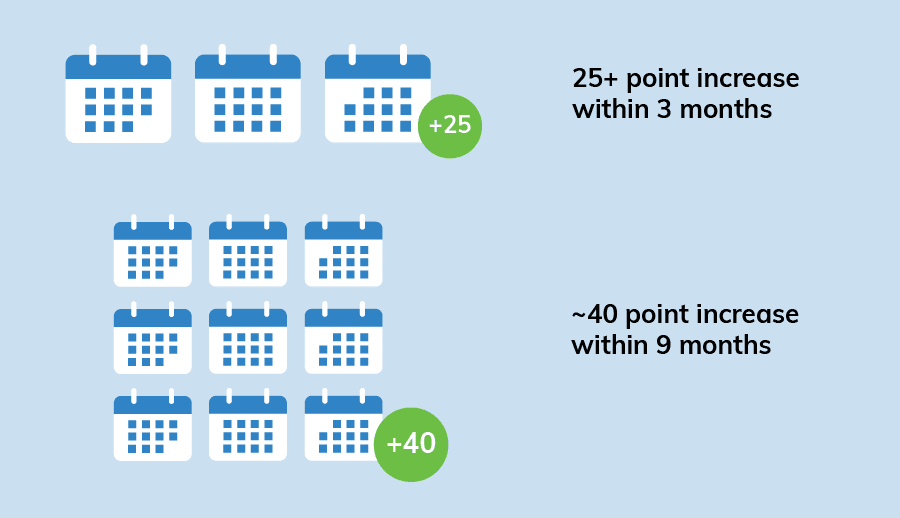

Building a strong credit score is a marathon, not a sprint, and it requires consistent, responsible financial behavior. Credit Strong offers a compelling and accessible solution for individuals looking to embark on or continue their credit-building journey. By combining a secured loan model with a built-in savings component, it provides a unique dual benefit: you not only establish a positive payment history that is reported to major credit bureaus but also accumulate a lump sum of savings.

While Credit Strong's services might be considered pricey compared to some alternatives, the value it offers in terms of structured credit building, forced savings, and accessibility for those with limited credit history can be substantial. The innovative Freekick program further extends this value to teens, fostering financial literacy from a young age. Remember, however, that credit profile improvement is not guaranteed, as your score reflects your overall financial behavior.

Ultimately, the decision to use Credit Strong, or any credit-building tool, should be based on a careful evaluation of your personal financial situation, goals, and budget. We encourage you to thoroughly research all options, understand the terms and conditions, and commit to responsible financial habits. If this article has helped clarify how Credit Strong works and its potential benefits, we invite you to share your thoughts in the comments below or share this guide with others who might benefit from this information. Your financial future is in your hands, and making informed choices is the first step towards achieving your goals.

- Hertz Customer Service

- Kerryn Feehan Nude

- Drew Rosenhaus

- Diamond Art Club

- Starbucks Customer Service

What Is a Credit Builder Loan, and Does It Work? - Credit Strong

Credit Strong Review for 2023: Is Credit Strong Worth It?

10 Best Credit Building Apps in 2024: Personally Ranked & Reviewed