Connecting With Confidence: Navigating Huntington Bank Customer Service

Table of Contents

- The Cornerstone of Banking: Understanding Huntington Bank Customer Service

- Navigating Your Options: How to Connect with Huntington Bank

- Comprehensive Support for Every Banking Need

- Dedicated Support for Huntington Bank Small Business Customers

- Around the Clock Assistance: Understanding Huntington's Availability

- Addressing Challenges and Building Trust

- Huntington's Commitment Beyond Transactions

- Optimizing Your Huntington Bank Customer Service Experience

The Cornerstone of Banking: Understanding Huntington Bank Customer Service

In the intricate world of personal finance and business operations, the quality of customer service can make or break a banking relationship. It's not just about having access to your money; it's about having reliable support when you need to understand a complex product, resolve a transaction dispute, or simply get a question answered quickly and accurately. Huntington Bank, established in 1866 and headquartered in Columbus, OH, has a long-standing history as one of the oldest banks in the U.S., with assets amounting to over $68 billion. This longevity speaks volumes about its foundational strength and commitment to its clientele. A critical aspect that underpins the trust customers place in Huntington Bank is its status as an Equal Housing Lender and a Member FDIC. This means that deposits in Huntington Bank are insured by the FDIC, providing a crucial layer of security and peace of mind for account holders. When you reach out to Huntington Bank customer service, you're connecting with an institution that prioritizes the safety and accessibility of your funds. The bank serves its customers from 732 locations, demonstrating a significant physical presence across its operating regions. This extensive network, combined with a robust digital infrastructure, aims to ensure that customers can receive help and support at any time, addressing their banking needs promptly and efficiently. The goal is to provide a seamless experience, whether you're inquiring about loans, payments, notary services, or tax forms, or simply need assistance with your checking, savings, credit cards, auto refinancing, or caregiver banking needs. Understanding these foundational elements helps set the stage for appreciating the depth and breadth of Huntington Bank's customer service offerings.Navigating Your Options: How to Connect with Huntington Bank

Huntington Bank understands that customers have diverse preferences when it comes to seeking assistance. Recognizing this, they offer multiple convenient channels for support, ensuring that help is always within reach. Whether you prefer a direct conversation, the efficiency of digital tools, or the personal touch of an in-person visit, Huntington Bank customer service is designed to accommodate your needs.Phone Banking: Direct Lines to Support

For many, a direct phone call remains the most effective way to resolve complex issues or get immediate answers. Huntington Bank provides comprehensive phone banking services, allowing customers to access their account balance, make payments, transfer money, and much more. Customer service representatives are available for general inquiries anytime from 7 a.m. ET on weekdays (Monday through Friday), and from 7 a.m. ET on weekends (Saturday and Sunday). Specifically, Huntington Bank’s general customer service operates from 7:00 am to 8:00 pm. To speak to a customer service representative, calling within these hours is recommended to ensure you connect with a live agent. This extensive availability ensures that even outside traditional business hours, you can still reach out for support. For instance, if you experience a lost or stolen card, you can use Huntington’s mobile app to report it and request a replacement, but a phone call might also be a quick way to ensure the card is immediately deactivated. The ability to learn how to access your account balance, make payments, transfer money, and more with Huntington phone banking service highlights the comprehensive nature of this channel.Online Banking & Mobile App: Convenience at Your Fingertips

In an increasingly digital world, online and mobile banking have become indispensable tools for managing finances. Huntington Bank excels in this area, offering secure and convenient features that empower customers to handle most of their banking needs from anywhere, at any time. With Huntington Bank's secure and convenient features, you can manage your money online, paying bills, transferring funds, depositing checks, and setting alerts with your favorite connected device. The Huntington mobile banking app, in particular, is a powerful tool designed to make managing your money simple and secure, whether it’s a checking or savings account, credit card, loan, or investment account. At home or on the go, you can check balances, pay bills, deposit checks, or transfer funds. The app also allows you to learn how to open accounts, sign up for alerts, reset passwords, and more, significantly reducing the need for a phone call or branch visit for routine tasks. This digital prowess is a testament to Huntington's commitment to modernizing Huntington Bank customer service and providing self-service options that cater to today's tech-savvy consumer.Branch Visits: Personalized In-Person Assistance

Despite the rise of digital banking, there are still times when nothing beats the personalized interaction of an in-person visit. Huntington Bank understands this need, maintaining a significant physical footprint with 781 locations on Yelp across the US, in addition to its stated 732 operational branches. These branches serve as vital hubs where customers can find a branch near them and receive direct assistance for more complex transactions or discussions. Services available at a branch often include notary services, assistance with tax forms, opening new accounts, or discussing loan options face-to-face. While online tools allow you to learn how to open accounts, sometimes the human element of a branch visit provides invaluable reassurance and clarity. The availability of in-person support ensures that even for needs that require detailed discussion or document handling, Huntington Bank customer service is readily accessible. Understanding Huntington Bank's hours on regular days, weekends, and holidays, and learning how to bank outside of business hours, is crucial for planning your branch visits effectively.Comprehensive Support for Every Banking Need

Huntington Bank's commitment to robust customer service extends across its entire spectrum of financial products and services. This means that whether you're an individual managing personal finances or a business navigating complex financial operations, you can find answers to common questions about Huntington Bank products and services. Their support structure is designed to address a wide array of inquiries, ensuring that no matter your banking need, assistance is available. For personal customers, this includes detailed support for managing checking and savings accounts, understanding credit card benefits and statements, navigating auto refinancing options, and even specialized services like caregiver banking. Questions about loan applications, payment schedules, or specific account features are all within the purview of their customer service representatives. For instance, if you're looking into a new personal loan or need clarification on your existing mortgage, Huntington Bank customer service can guide you through the process, explain terms, and help you understand your options. They also assist with practical matters like notary services, which are often essential for legal and financial documents, and provide guidance on tax forms relevant to your banking activities. The breadth of these offerings underscores Huntington's dedication to being a full-service financial partner, ready to support you through every stage of your financial journey.Dedicated Support for Huntington Bank Small Business Customers

Small businesses are the backbone of the economy, and their banking needs are often distinct and more complex than those of individual consumers. Recognizing this, Huntington Bank provides specialized customer service tailored specifically for its small business clientele. This dedicated support ensures that business owners can access expert advice and efficient solutions for their unique financial challenges. For business banking customers, the customer service operates from Monday to Friday, from 8:00 am to 8:00 pm. This extended weekday availability acknowledges the demanding schedules of business owners, providing ample opportunity to connect with a representative. Whether you need assistance with business checking accounts, merchant services, business loans, or treasury management solutions, the dedicated team is equipped to help. You can find the phone number, address, and other details specifically for Huntington Bank small business customers, making it easier to navigate the support channels. This focus on specialized assistance highlights Huntington's understanding that effective Huntington Bank customer service for businesses requires a nuanced approach, offering not just answers but also strategic guidance that can impact a company's financial health and growth.Around the Clock Assistance: Understanding Huntington's Availability

Accessibility is a key pillar of effective customer service, and Huntington Bank strives to ensure its customers can connect with support when they need it most. While direct phone lines have specific operating hours, the combination of digital tools and extended availability for certain services means that help is often just a few clicks or a call away, even outside traditional banking hours. As previously mentioned, Huntington Bank’s general customer service works from 7:00 am to 8:00 pm, with customer service representatives available anytime from 7 a.m. ET on weekdays (Monday through Friday), and from 7 a.m. ET on weekends (Saturday and Sunday). This means you can speak to a customer service representative by calling between 7:00 a.m. and 8:00 p.m. ET, seven days a week. For business banking customers, the hours are Monday to Friday, from 8:00 am to 8:00 pm. This ensures that customers can receive help and support at any time, addressing their banking needs promptly. Beyond these direct phone lines, Huntington's digital platforms offer 24/7 access to account information and self-service functionalities. The mobile app and online banking portal allow you to check balances, pay bills, transfer funds, and deposit checks at any hour, day or night. If you're wondering, "Is Huntington Bank open on [a specific holiday]?" or "How can I bank outside of business hours?", the answer often lies in their robust digital ecosystem. While branches have set hours that vary by location and day, the comprehensive digital tools provide a continuous banking experience, allowing you to manage most aspects of your finances without waiting for business hours. This blend of live support during peak times and constant digital access truly defines the accessibility of Huntington Bank customer service.Addressing Challenges and Building Trust

No financial institution is without its challenges, and customer feedback, whether positive or negative, is a crucial part of continuous improvement. While Huntington Bank strives for excellence in its customer service, it's important to acknowledge that the rating indicates that most customers are generally dissatisfied on platforms like Yelp, where Huntington Bank has 781 locations. This feedback, while critical, serves as a catalyst for ongoing efforts to enhance the customer experience. Huntington Bank's commitment to improvement is evident in statements such as, "We apologize for any inconvenience as we work to improve your online banking experience." This reflects a proactive stance towards addressing areas where customers might face friction, particularly in the digital realm. The core objective remains consistent: to ensure that customers can receive help and support at any time, addressing their banking needs promptly. Building trust, especially in the "Your Money or Your Life" (YMYL) domain of finance, requires transparency and a demonstrated commitment to resolving issues. The bank's long history, its status as a Member FDIC, and its dedication to providing multiple contact channels are all elements that contribute to establishing this trust. When issues arise, knowing that you can contact Huntington by phone, online, or visit a branch near you provides essential reassurance. The focus is not just on fixing immediate problems but on fostering long-term relationships built on reliability and responsiveness, which is at the heart of effective Huntington Bank customer service.Huntington's Commitment Beyond Transactions

Huntington Bank's presence extends beyond just financial transactions; it's deeply woven into the fabric of the communities it serves. This broader commitment to community involvement and a distinct corporate culture also subtly influences the approach to Huntington Bank customer service. When you interact with Huntington, you're engaging with an institution that prides itself on its heritage and its role as a responsible corporate citizen. The official website, huntington.com, is not just a portal for banking services but also a place where you can learn more about Huntington's culture and community involvement. This includes initiatives that support local economies, promote financial literacy, and contribute to the well-being of the areas where its customers live and work. The bank's registered service marks, such as Huntington®, Huntington.Welcome.®, and Huntington Heads Up®, represent not just brand identity but also a promise of service and innovation. These elements collectively contribute to an overarching ethos that aims to provide not just transactional support but also a sense of partnership and reliability. This holistic view of banking, where customer service is part of a larger commitment to community and values, helps to differentiate Huntington Bank and reinforces its dedication to its customer base.Optimizing Your Huntington Bank Customer Service Experience

To truly maximize the benefits of Huntington Bank customer service, it's helpful for customers to adopt a proactive approach. While Huntington provides numerous avenues for support, a little preparation can significantly enhance the efficiency and effectiveness of your interactions. Firstly, whenever possible, start with Huntington's extensive online resources. The official website and mobile app are treasure troves of information, designed to help you find answers to common questions about Huntington Bank products and services, such as loans, payments, notary, tax forms, and more. Many routine inquiries, like how to open accounts, sign up for alerts, or reset passwords, can be resolved quickly through these self-service options, saving you time. Secondly, if a phone call or branch visit is necessary, gather all relevant information beforehand. This includes your account number, any specific transaction details, dates, and a clear description of your issue or question. Having this information readily available will allow the customer service representative to assist you more efficiently. Remember that customer service representatives are available anytime from 7 a.m. ET on weekdays (Monday through Friday), and from 7 a.m. ET on weekends (Saturday and Sunday), with business banking hours from 8:00 am to 8:00 pm Monday to Friday. Knowing these hours helps you time your call for optimal assistance. Finally, utilize the digital tools for convenience. The Huntington mobile banking app helps make managing your money simple and secure, allowing you to check balances, pay bills, deposit checks, or transfer funds at home or on the go. You can also use Huntington’s mobile app to report a lost or stolen card and request a replacement, providing immediate action for critical issues. By leveraging the full suite of options available, from detailed FAQs to direct phone lines and in-person support, you can ensure a smooth and effective Huntington Bank customer service experience.Conclusion

Huntington Bank has clearly invested significantly in developing a comprehensive and accessible customer service framework. From its extensive network of physical branches and dedicated phone lines to its robust online banking portal and intuitive mobile app, the bank offers numerous pathways for customers to find answers, manage their finances, and resolve issues. The commitment to extended hours, specialized support for small businesses, and the underlying security of FDIC insurance all contribute to a banking experience designed for reliability and peace of mind. While customer feedback indicates areas for continuous improvement, Huntington Bank's long-standing history, its deep community involvement, and its ongoing efforts to enhance digital services demonstrate a clear dedication to its clientele. The ability to find answers to common questions about Huntington Bank products and services, contact Huntington by phone, online, or visit a branch near you, and manage your money with secure and convenient features, underscores the bank's commitment to supporting its customers' financial journeys. Ultimately, understanding and utilizing these diverse channels empowers you to connect with confidence, ensuring that your banking needs are addressed promptly and effectively. Thank you for banking with Huntington.

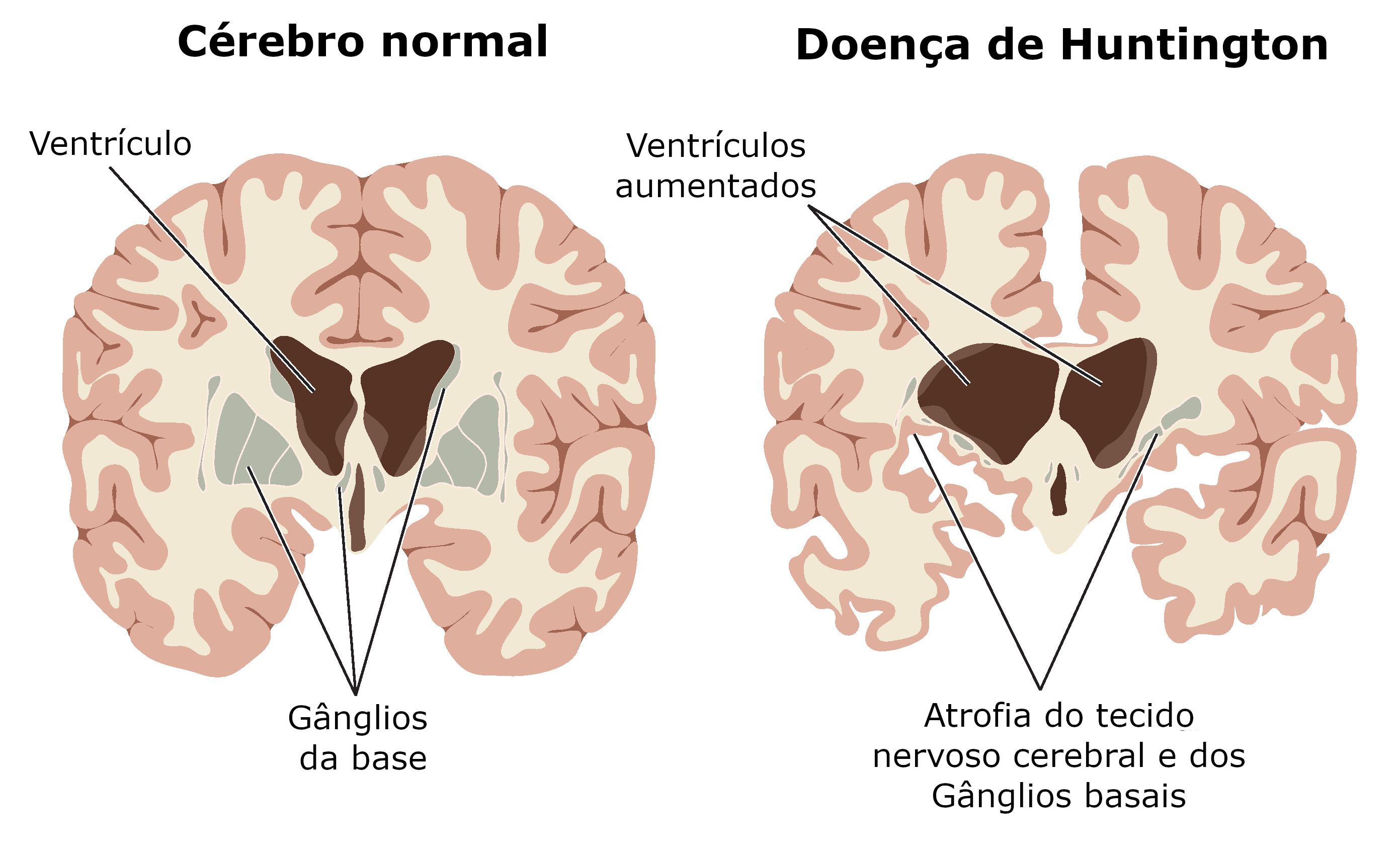

Doença de Huntington - causas, sintomas, tratamentos - InfoEscola

:max_bytes(150000):strip_icc()/huntingtons-disease-symptoms-5091956-Final-c6e5d478c42945b593bafa65d9408e23.jpg)

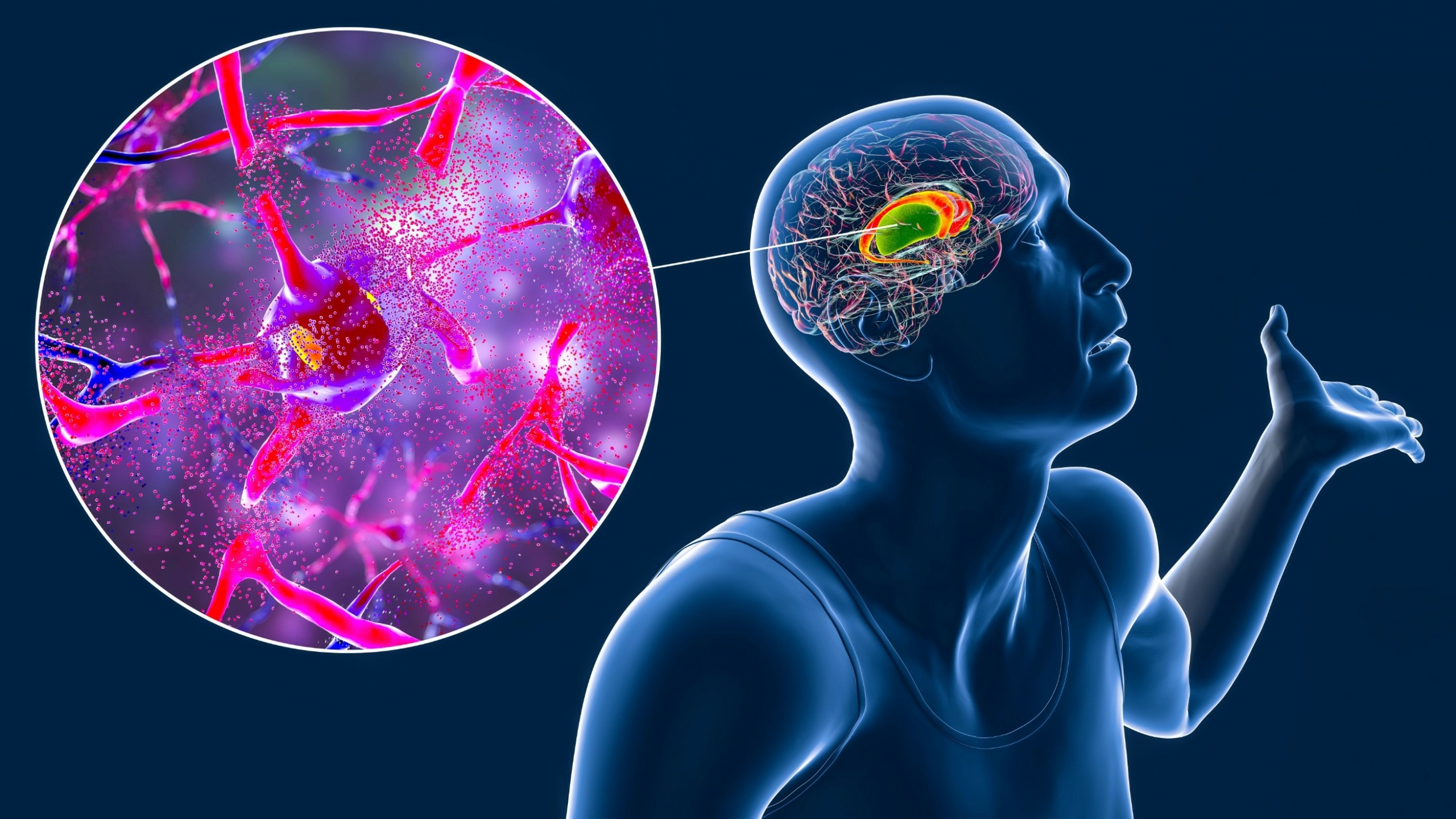

Huntington's Disease: Signs, Symptoms, Complications

Is there a cure for Huntington's disease? Improving autophagy could be