Unpacking 'Carta De Buena Fe' In Equity Management With Carta

Building trust, it's pretty important in business, isn't it? Especially when we talk about something as vital as company ownership and shares. Think about all the agreements, the promises, and the shared goals that keep a business moving forward. A sense of genuine good intentions, or what we might call "buena fe," is really at the core of these connections. It helps everyone feel secure and ready to work together for success.

This idea of acting with good faith, or "carta de buena fe," is more than just a nice thought; it’s a practical way of doing things that makes everything smoother. When people believe others are acting fairly and honestly, it cuts down on misunderstandings and helps deals get done. It's about having clear expectations and making sure everyone is on the same page, which can feel like a big job for anyone managing a company's shares or investments, you know?

Today, as businesses grow and change, finding ways to make sure this good faith is present in every step becomes even more important. This is where platforms like Carta come into play. They help people manage equity, build businesses, and invest in the companies of tomorrow. The tools and services offered by Carta, in a way, help formalize and uphold that spirit of "buena fe" in the complex world of company ownership and finance. It's almost like they provide a framework for honest dealings.

- Jason Tipple Ri

- Catching Fireflies Musical

- Hanabi Hibachi Sushi

- Phi Kappa Sigma Msu

- The Banyan Live West Palm Beach

Table of Contents

- What is "Good Faith" Anyway?

- How Carta Helps Build "Good Faith"

- Benefits of a "Good Faith" Approach to Equity

- Frequently Asked Questions About Equity and Trust

- Bringing It All Together

What is "Good Faith" Anyway?

The phrase "carta de buena fe" directly translates to "letter of good faith." It points to an honest intention or a sincere belief that one is acting fairly and without trying to trick anyone. In the world of business and law, it means conducting oneself with integrity, being truthful, and holding up one's end of a deal. It's about being straightforward, you know, and not having any hidden agendas. This concept is pretty foundational to how people interact in any sort of agreement or partnership, so it’s something we value quite a bit.

When someone acts with good faith, they are being transparent and fair, even when things get a little tough. It's not just about following the rules; it's about following the spirit of the rules too. This kind of conduct builds strong relationships and helps prevent problems before they even start. It really makes a difference in how smoothly things run, especially in complicated situations like managing company shares. For more about the general concept of good faith, you can look at resources explaining its meaning in various contexts, for example, in legal terms, it refers to an honest belief or absence of malice.

Why Good Faith Matters in Business

In business, good faith is like the glue that holds everything together. Without it, every transaction, every partnership, and every employee relationship would be filled with suspicion. When founders issue shares to investors or employees, there's an unspoken promise that everything is legitimate and that the records are accurate. This trust is absolutely vital for growth, for fundraising, and for attracting good people to work with you. It’s the basis for reliable interactions, that’s for sure.

- Airbnb Interior Design Services

- 120 Prince St

- Om Grown Yoga Bryan Tx

- Sequoia Zamalek Cairo Egypt

- Sohan Patel Golf

Imagine trying to raise money for a startup if investors couldn't trust the numbers or the ownership records. It would be nearly impossible, right? Good faith helps create an environment where everyone can feel secure in their dealings. It reduces friction and helps people focus on building and innovating, rather than constantly worrying about whether someone is being straight with them. This is why having clear, verifiable processes is so important, as it really supports that feeling of trust.

How Carta Helps Build "Good Faith"

Carta, as a platform, doesn't issue a literal "carta de buena fe." Instead, it provides the tools and systems that help businesses operate with that very spirit of good faith, especially when it comes to managing equity. It helps make sure that the information about who owns what is clear, accurate, and easily accessible to those who need to see it. This transparency is a big part of building and keeping trust among founders, investors, and employees, so it’s pretty useful.

The platform helps companies manage equity, build businesses, and invest in the companies of tomorrow. This means it helps founders issue digital share certificates to investors, employees, and others who qualify for stock options. By providing a centralized place for all this important information, Carta helps ensure that everyone involved has access to the same, correct details, which is quite a step towards fostering good faith dealings.

One of the ways Carta helps with good faith is through its digital share certificates. Instead of old paper certificates that can get lost or altered, Carta's software allows company founders to issue digital share certificates. These are secure and verifiable, which means there’s less chance for mistakes or disagreements about who owns what. It's a way of making sure the records are solid and dependable, you know, and that really helps build confidence.

When an investor or an employee receives an invitation to accept a security, they do so through a clear, digital process. This removes a lot of the guesswork and potential for error that might come with traditional methods. Knowing that your ownership stake is recorded accurately and securely on a platform like Carta helps everyone feel more comfortable and trusting in the equity arrangements. This level of clarity is pretty important for peace of mind.

Centralized Information: Clarity for Everyone

Carta also develops a centralized dashboard. This means all the important information about equity, ownership, and investments is in one place, easy to see and manage. This kind of single source of truth is incredibly helpful for maintaining good faith because it ensures everyone is looking at the same data. There's no room for different versions of the truth, which can sometimes cause problems, you see.

Founders, CFOs, investors, and even employees can log into their accounts to view their holdings, track transactions, and manage their fund. This open access to accurate, up-to-date information reduces potential for disputes and fosters a shared understanding of the company's equity structure. It's a pretty straightforward way to keep everyone aligned and informed.

Streamlined Transactions: Smooth and Secure

Beyond just holding information, Carta helps issue, track, and process payments for your securities from one platform. This streamlining of transactions means that the process of giving out shares, or managing payments related to them, is clear and recorded. When transactions are handled securely and transparently, it reinforces the idea that all parties are acting with honest intentions. It’s a bit like having a clear trail for everything, which is quite reassuring.

If you've received an invitation to access a portfolio, accept a role as a board member, or accept a security, you'll need an account to do so. This structured process helps ensure that every step is verified and properly recorded, which contributes to the overall integrity of the equity management process. This approach really helps minimize any potential for confusion or disagreement.

Scaling with Integrity: From Startup to Growth

Accessing solutions designed to scale from fundraising to hiring and IPO is another way Carta supports good faith. As a company grows, its equity structure can become incredibly complex. Trying to manage this manually or with outdated systems can lead to errors, which can then lead to a breakdown in trust. Carta provides the tools to manage this complexity cleanly and accurately, even as a business expands rapidly. It really helps keep things orderly as you grow.

By helping companies maintain accurate and organized equity records from the very beginning, Carta helps them avoid problems down the line that could jeopardize investor relations or employee morale. This foresight in managing equity with precision is a clear demonstration of a company's commitment to operating with good faith in all its financial dealings. It's a proactive way to build lasting trust.

Community and Expert Guidance: Support for Sound Decisions

Joining the Carta community means you can connect with founders, CFOs, law firm partners, and equity admins. This network, along with access to expert support, exclusive resources, and insights on equity compensation, means that people have the information and help they need to make sound decisions. When you have good guidance, you're more likely to act correctly and fairly, which, you know, is a big part of good faith.

If you can't find what you're looking for, or if you're experiencing issues authenticating your credentials, reaching out to Carta support is an option. This kind of readily available help ensures that users can resolve problems quickly and keep their equity management on track. This support system helps people uphold their commitments and maintain accurate records, which is pretty helpful for everyone involved.

Benefits of a "Good Faith" Approach to Equity

When a company uses a platform like Carta to manage its equity with transparency and accuracy, it naturally fosters a "buena fe" environment. This approach brings several clear advantages that benefit everyone involved, from the people running the company to those who have invested in it. It really makes a positive impact on the whole business.

Attracting and Keeping Talent

Employees who receive stock options or other forms of equity want to feel confident that their ownership is real and properly recorded. When a company uses a system that is clear and secure, it sends a strong message that the company values transparency and treats its people fairly. This can make a big difference in attracting talented individuals and keeping them happy and committed to the company's future. It's a way of showing you mean business, in a good way.

Investor Confidence

Investors put their money into companies with the expectation of clear and accurate reporting. A platform that provides a centralized, verifiable record of all equity helps build significant confidence with investors. They can easily see their holdings and trust that the company's cap table is clean and well-managed. This trust can be absolutely vital for future fundraising rounds and for maintaining strong relationships with those who have put their faith in your business. It's a pretty strong selling point, actually.

Legal Soundness and Less Worry

Operating with good faith, supported by a platform like Carta, means that a company's equity management is more likely to be legally sound. Accurate records and streamlined processes help ensure compliance with regulations, which can help avoid costly legal issues down the road. This reduces a lot of worry for founders and their legal teams, allowing them to focus more on growing the business and less on potential problems. It gives everyone a bit more peace of mind, you know.

Frequently Asked Questions About Equity and Trust

People often have questions about how equity works and how to make sure everything is handled fairly. Here are some common inquiries, you know, that might come up.

How does a platform like Carta make equity management more trustworthy?

A platform like Carta helps by creating a single, secure source of truth for all equity records. It issues digital share certificates, which are less prone to errors than paper ones, and provides a centralized dashboard where everyone can view accurate information. This transparency and consistent data really help build trust among all parties involved, so it’s pretty helpful.

Why is it important for a startup to manage equity with good faith from the beginning?

Starting with good faith in equity management sets a strong foundation for a company's future. It helps attract and keep good people, builds confidence with investors, and ensures legal compliance. This early commitment to transparency and accuracy can prevent big problems as the company grows, making the path to success much smoother, you know, and less stressful.

Can using a digital platform truly replace traditional legal documents for equity?

Digital platforms like Carta work alongside traditional legal frameworks. They don't replace the need for legal advice or properly drafted agreements. Instead, they provide a secure and verifiable way to manage and record the details of those agreements, like issuing digital share certificates. This makes the process more efficient and transparent, supporting the legal documents rather than replacing them, you see.

Bringing It All Together

The idea of a "carta de buena fe" is really about acting with honest intentions and building trust. While Carta doesn't literally hand you a paper letter of good faith, its entire system works to create an environment where good faith in equity management can truly thrive. By offering digital share certificates, a centralized dashboard, and streamlined processes, it helps ensure transparency and accuracy for everyone involved.

This commitment to clarity and security helps founders, investors, and employees feel confident in their dealings. It makes managing equity simpler, reduces the chances of misunderstandings, and supports companies as they grow. To learn more about how Carta helps businesses manage their equity and to see how its platform supports a clear and fair approach to ownership, you might want to explore the features available. You can also get started by creating an account above to get started, or learn how to track, transact, and manage your fund on Carta’s platform, which could be quite beneficial for your business.

- Lonnie Grover Dallas

- The Battersea Barge

- Carrie Keagan Erome

- Main Street High Photos

- Brandon Hagen Age

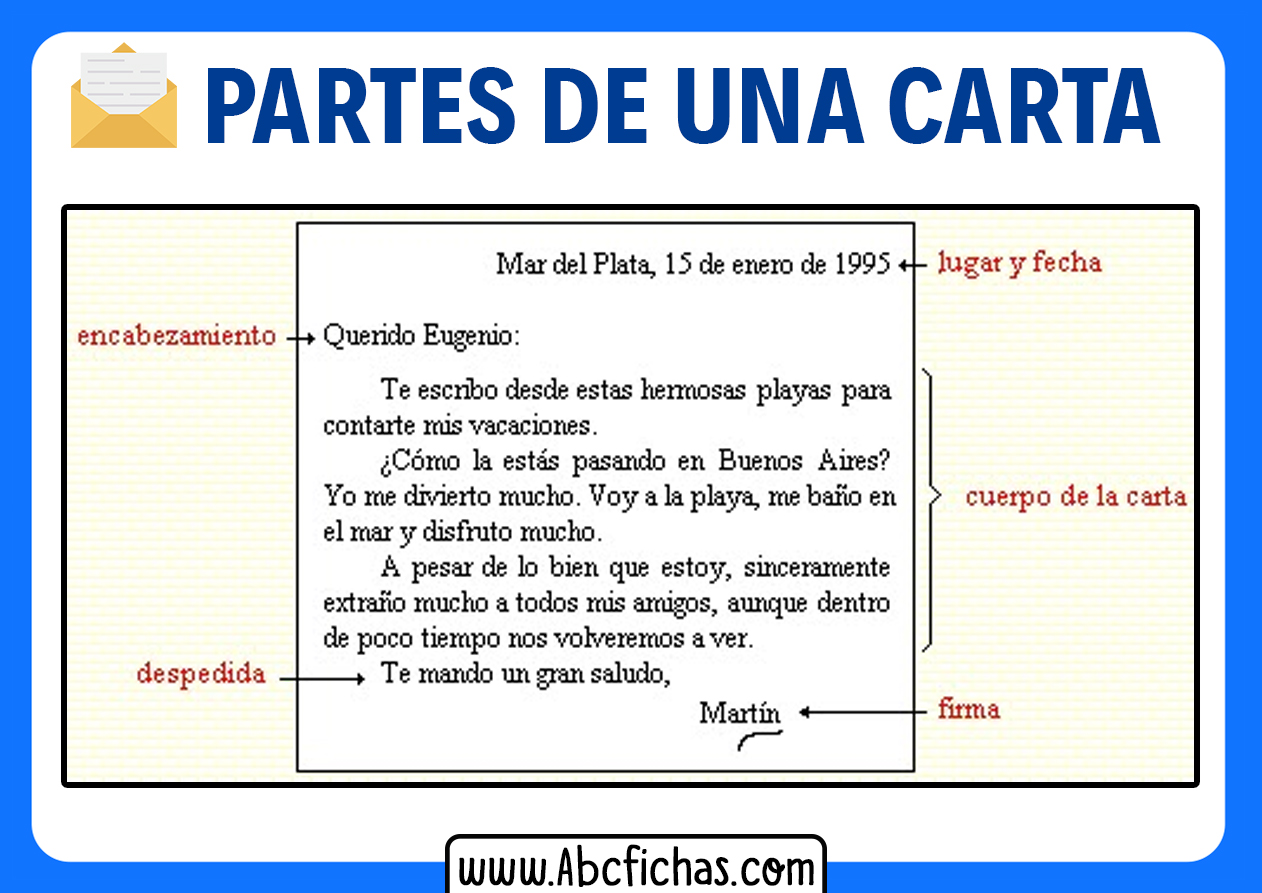

Partes De Una Carta Formal Estructura Y Elementos Carta Formal Partes

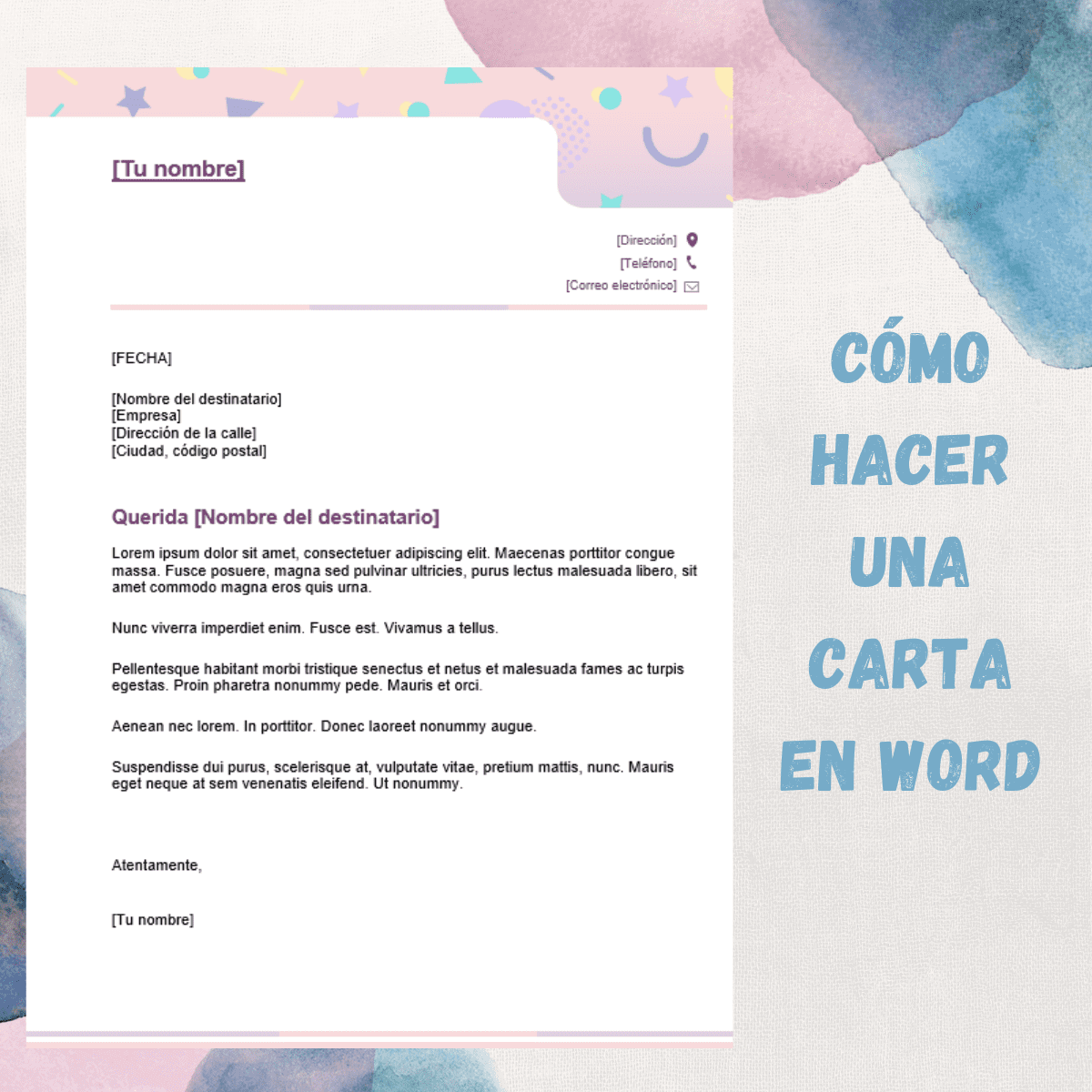

Como Hacer Una Carta De Solicitud En Word 2021 Youtube – eroppa

Cómo Redactar una Carta Formal: Guía de Funciones y Ejemplos - Escuela