Exploring Companies Like Flex Rent For Easier Payments

Rent is, for many of us, the biggest single expense each month. It's a payment that looms large, and for a lot of people, that big lump sum can feel like a real challenge to manage, especially if paychecks don't line up perfectly with the first of the month. You know, like, sometimes your payday might be the 15th, but rent is due on the 1st, and that can really throw off your budgeting. It's almost as if the traditional rent cycle wasn't designed for how many people actually get paid these days.

This is where services, a bit like Flex Rent, step in to make things a whole lot smoother. They offer a fresh way to handle your rent, letting you break it down into smaller, more frequent payments instead of one big hit. It's a concept that is gaining a lot of interest, particularly among folks who want a bit more control over their money flow and want to avoid that monthly scramble.

So, if you've ever felt that pinch, or if you're just looking for smarter ways to manage your household finances, then exploring companies like Flex Rent could really be worth your time. These kinds of services are changing how we think about paying for our homes, making it, you know, a bit more flexible and less stressful for everyone involved.

- Momos Bar Portland

- Roadhouse Momo And Grill Photos

- Bass Vault Sf

- The Banyan Live West Palm Beach

- Popular Dog Hashtags

Table of Contents

- What Are Flexible Rent Payment Services?

- Why Look for Companies Like Flex Rent?

- Key Features to Look for in Flexible Rent Apps

- Top Companies Offering Flexible Rent Solutions

- How These Services Can Help You (and Your Landlord)

- Common Questions About Flexible Rent Payments (FAQ)

- Making the Right Choice for Your Rent

What Are Flexible Rent Payment Services?

Flexible rent payment services are, in a way, financial tools that let renters pay their monthly housing costs in smaller, more frequent chunks, rather than one large sum on a specific date. You know, traditionally, rent is due on the first of the month, and that's it. But these services come along and say, "Hey, what if you could pay a bit every week, or every two weeks, aligning it with when you actually get paid?" It's a pretty neat idea, really.

The core concept is to smooth out your cash flow. Instead of needing, say, a thousand dollars all at once, you might pay two hundred and fifty dollars each week. This can make a huge difference for folks who live paycheck to paycheck, or whose income streams aren't always predictable. It's about making a big bill feel, you know, a lot less daunting.

These companies typically work by acting as an intermediary between you and your landlord. You pay them smaller amounts over time, and then, when the rent is due, they send the full amount to your landlord. It's a simple, yet very effective, solution for a common financial stress point. This kind of arrangement, frankly, helps many people keep their budgets balanced.

- Katy Spratte Joyce

- Jason Tipple Ri

- Phi Kappa Sigma Msu

- Melvin Nunnery Net Worth

- Washington Street Skate Park Photos

Why Look for Companies Like Flex Rent?

There are quite a few good reasons why someone might start looking into companies that offer flexible rent payments. It's not just about convenience, though that is a big part of it. It’s also about gaining a sense of calm and control over your personal finances. For example, if you're like many people, your paychecks don't always arrive on the exact same day your rent is due, which can be a real headache.

One major draw is the ability to manage your money more effectively throughout the month. Instead of having to save up a big chunk of money and hold onto it until the first, you can allocate smaller portions as your income comes in. This makes budgeting feel, you know, a lot more natural and less like a constant struggle. It’s a bit like having a steady drip rather than a sudden downpour when it comes to your expenses.

Another reason is to avoid those pesky late fees. We’ve all been there, where a payment slips your mind, or funds are just a little tight when the rent is due. These services can help make sure your landlord gets their money on time, every time, saving you from extra charges that can really add up. It’s a simple way to protect your budget, in a way, from unexpected hits.

Managing Cash Flow Better

For many individuals, especially those with variable incomes or who get paid bi-weekly, managing a large monthly rent payment can feel like a constant juggle. Flexible payment services, like, let you align your rent payments with your income schedule. This means you can pay a little bit each time you get paid, instead of waiting for one big payday to cover the entire amount. It's a system that just makes sense for how a lot of people earn their money today.

This approach helps prevent that feeling of being cash-strapped right after rent is paid. You know, when you've just handed over a huge sum, and your bank account feels a bit empty for the rest of the month. By spreading out the payments, you keep more money in your account for day-to-day expenses, which, frankly, reduces a lot of stress. It really smooths things out, allowing for a more consistent financial flow.

It's about making your money work for you, rather than feeling like you're constantly chasing it. This can lead to a much healthier financial picture overall, as you're less likely to overspend or fall short on other bills. It’s a pretty practical way to handle your biggest monthly expense.

Avoiding Late Fees

Late fees are, honestly, one of the most frustrating parts of renting. They're extra charges that pop up when your rent isn't paid by the due date, and they can really add unnecessary costs to your budget. For example, a late fee could be fifty or even a hundred dollars, and that's money you could be using for groceries or other important things. You know, nobody wants to pay more than they have to.

Companies that offer flexible rent payments can help you sidestep these charges entirely. By setting up smaller, more frequent payments, you reduce the risk of forgetting a payment or not having enough money ready on the first of the month. The service ensures the full amount reaches your landlord on time, so you don't have to worry about those extra penalties. It’s a pretty straightforward way to protect your wallet.

This peace of mind is, in some respects, invaluable. Knowing that your rent is taken care of, bit by bit, and that you won't be hit with a surprise late fee, can make a huge difference to your overall financial well-being. It’s a smart move for anyone who wants to avoid those costly slip-ups, which, you know, happen to the best of us.

Building Financial Habits

Using a flexible rent payment service can actually help you develop better money habits. When you're making smaller, regular payments, it encourages a more consistent approach to budgeting and saving. It’s like, instead of a big sprint once a month, you're doing a steady jog, which is much more sustainable. This kind of routine can be really beneficial for anyone looking to improve their financial discipline.

It teaches you to allocate funds for rent as soon as you receive income, rather than waiting until the last minute. This proactive approach can spill over into other areas of your financial life, helping you to save for other goals or manage other bills more effectively. You know, it's about building that muscle memory for responsible spending and saving.

Over time, these small, consistent actions can lead to a greater sense of financial security and control. It's a practical way to build a foundation for a healthier financial future, helping you feel more confident about your money situation. It’s pretty empowering, actually, to see your habits improve.

Key Features to Look for in Flexible Rent Apps

When you're checking out companies like Flex Rent, there are a few important things you'll want to keep an eye on. Not all services are exactly alike, and some features might be more important to you than others. It's about finding the right fit for your specific needs and how you prefer to handle your money. You know, it's a bit like choosing the right tool for a job.

Consider how easily the service connects with your landlord's system. Some services might require your landlord to sign up, while others can send payments directly, even if your landlord isn't officially partnered with them. This is, like, a pretty big deal, as it affects how smoothly everything runs. You want a service that makes things easier, not more complicated.

Also, think about what kind of customer support they offer. If you have a question or an issue, you'll want to know that you can get help quickly and easily. A good support team can make a huge difference in your experience. It's about feeling supported, which is, you know, really important when it comes to your money.

Payment Scheduling Options

One of the most important things to look for in a flexible rent service is how many options they give you for scheduling your payments. Some services might only offer bi-weekly payments, while others let you choose weekly, or even specific dates that align with your paydays. You know, having that choice is pretty crucial for making the service truly work for your personal income schedule.

You'll want to see if you can set up automatic payments, too. This is a huge convenience, as it means you don't have to remember to log in and make a payment every time. Once it's set up, it just happens, which is, frankly, a massive time-saver. It's all about making your life a little bit easier.

Also, check if they allow you to adjust your payment schedule if your income changes or if you have an unexpected expense. Life happens, and sometimes you need that flexibility. A service that understands this and lets you tweak your plan is, arguably, a lot more user-friendly. It’s about adapting to your life, not the other way around.

Fee Structures

Understanding the fees involved with any flexible rent payment service is, like, super important. Some companies charge a small fee per transaction, while others might have a monthly subscription fee. You need to know exactly what you'll be paying so there are no surprises down the road. It's, you know, all about transparency when it comes to your money.

Make sure to compare these fees across different services. A small fee might seem insignificant at first, but over a year, it can really add up. For instance, a five-dollar transaction fee paid twice a month is one hundred and twenty dollars a year, which is, you know, a decent amount of money. You want to pick a service that offers good value for what you're getting.

Some services might even offer a free tier with basic features, or they might waive fees under certain conditions. It's always a good idea to read the fine print and ask questions if anything is unclear. You want to feel confident that you're making a financially smart choice, which, honestly, involves knowing all the costs upfront.

Integration with Landlords and Property Managers

How well a flexible rent service works with your landlord or property manager is, frankly, a really big deal. Some services require your landlord to sign up and use their platform directly. This can be great if your landlord is on board, as it often means smoother communication and fewer potential hiccups. It’s, you know, a more integrated approach.

Other services might not need your landlord to do anything special. They simply collect your smaller payments and then send one lump sum to your landlord via their preferred method, like a bank transfer or a check. This can be a good option if your landlord is, perhaps, a bit old-fashioned or just not interested in trying new tech. It offers flexibility for both sides, which is pretty useful.

Before you commit to any service, it’s a good idea to chat with your landlord or property manager. Ask them if they have any preferences or if they’re open to receiving payments through a new system. Their cooperation can make the whole process much easier for everyone involved. You want to make sure it’s a good fit for both you and your landlord, you know, for a smooth rental experience.

Credit Reporting Benefits

Some flexible rent payment services offer the added benefit of reporting your on-time rent payments to credit bureaus. This is, honestly, a pretty powerful feature, because for many people, rent is their largest consistent payment, but it doesn't always show up on their credit report. Getting it reported can really help build your credit score, which is, you know, super important for things like getting loans or even better insurance rates.

If building your credit is a goal for you, then looking for a service that includes this feature is, arguably, a smart move. It turns a regular expense into an asset for your financial future. You're paying rent anyway, so why not get some credit-building benefits out of it? It’s like getting a bonus for something you’re already doing.

Always confirm which credit bureaus they report to, and how consistently they do it. Not all services are the same in this regard. This feature can be a real game-changer for people looking to establish or improve their credit history, turning a simple payment into a positive financial step. It's a pretty compelling reason, actually, to consider these types of services.

Top Companies Offering Flexible Rent Solutions

When you start looking for companies like Flex Rent, you'll find a growing number of services trying to make rent payments easier. While specific company names can change and offerings evolve, it's useful to know the kinds of options out there. These services generally fall into a few categories, each with its own approach to helping you manage your rent. You know, it's a pretty diverse field.

Some services focus heavily on integrating directly with landlords, providing a portal for both renters and property managers. These often aim to streamline the entire payment process for larger property management companies. For example, a company might offer a full suite of tools for landlords, and flexible payments are just one part of that. This can be really helpful if your landlord is already using a compatible system.

Other companies act more as a direct service for the renter, collecting payments from you and then ensuring the full rent reaches your landlord, regardless of their payment system. These are often more appealing to individual renters whose landlords might not be tech-savvy or prefer traditional payment methods. It’s about providing a bridge, in a way, between your flexible payments and their fixed needs.

Then there are services that also layer on additional financial tools, like credit building or budgeting advice, alongside their flexible payment options. These are designed to be more comprehensive financial partners, helping you with more than just rent. They might offer insights into your spending habits or ways to save money, which, frankly, can be very useful. It’s about a more holistic approach to your money.

When you're comparing them, consider what matters most to you: is it the lowest fee, the easiest landlord integration, or the extra financial perks? Each company has its own strengths, and what works best for one person might not be the ideal choice for another. It's a very personal decision, you know, based on your own situation.

For instance, one service might be great if you're looking to, say, build your credit history specifically, while another might be better if you just want the simplest way to split your payments without any fuss. It’s really about aligning the service's strengths with your own priorities. You can learn more about financial tools on our site, and also check out this page for more budgeting tips.

How These Services Can Help You (and Your Landlord)

Flexible rent payment services are, in a way, a win-win for both renters and landlords. For you, the renter, it’s about taking control of your largest monthly expense and making it fit better into your financial life. It reduces the stress of that big lump sum payment and helps you manage your money more smoothly throughout the month. This can lead to, you know, a much calmer financial outlook.

For landlords, these services can mean more consistent and on-time rent payments. When renters have an easier time paying, they're less likely to be late or miss a payment altogether. This helps landlords maintain a steady income stream and reduces the need for them to chase down late payments, which, frankly, can be a time-consuming and frustrating task. It’s about making their job a little bit easier, too.

These services can also help improve the relationship between renters and landlords. When payments are smooth and reliable, it builds trust and reduces potential friction. A happy renter is, you know, more likely to stay longer, which benefits the landlord by reducing turnover costs. It’s a pretty simple concept, but it has a big impact.

Some services even offer landlords better insights into payment trends or help them automate their accounting, which is, arguably, a valuable feature for businesses of any size. For example, a company that provides language training to big and small companies in 34 countries around the world understands how different businesses operate; similarly, these rent payment services cater to diverse needs. It’s about creating a more efficient and positive experience for everyone involved in the rental process. This kind of innovation is, frankly, pretty exciting.

Common Questions About Flexible Rent Payments (FAQ)

People often have questions when they first hear about companies like Flex Rent. It's natural to be curious about how these new financial tools work and if they're a good fit for you. Here are some common questions folks often ask, which, you know, might help you get a clearer picture.

Is Flex Rent legitimate?

Yes, services like Flex Rent are legitimate companies that provide a service for managing rent payments. They operate by allowing you to make smaller payments over time, and then they ensure your full rent reaches your landlord on the due date. These are, basically, financial technology companies that aim to make a specific part of your budgeting easier. Always check reviews and understand their terms, which is, you know, good practice for any service.

Does Flex Rent charge fees?

Most companies offering flexible rent payment services do charge some kind of fee. This could be a small transaction fee for each payment you make, or a monthly subscription fee for using their service. The exact amount and structure of these fees vary from company to company, so it's really important to look at their pricing details before you sign up. You want to make sure the cost is worth the convenience for you.

What are the pros and cons of flexible rent payments?

The main pros include better cash flow management, helping you avoid late fees, and potentially building your credit history if the service reports payments. It makes budgeting feel, you know, a lot less stressful. The cons often involve the fees associated with the service, and sometimes, the need for your landlord to be on board with the system. It’s about weighing the benefits against the costs and potential hurdles for your own situation.

Making the Right Choice for Your Rent

Choosing the right flexible rent payment service is, like, a pretty personal decision. It really comes down to your own financial situation, how you prefer to manage your money, and what your landlord's preferences are. There are many companies out there offering similar services to Flex Rent, and each has its own set of features, fees, and ways of working. You know, it's about finding the best fit for you.

Take some time to look at different options. Compare their fee structures, check what kind of payment scheduling they offer, and see if they have any extra benefits, like credit reporting. Don't be afraid to ask questions, either from the service providers themselves or from your landlord. For example, understanding how a company like Harvard University operates or how Microsoft Corporation manages its finances can give you a general idea of how large organizations function, but for these services, you need to dig into the specifics.

Ultimately, the goal is to make paying your rent a smoother, less stressful part of your month. These services are designed to help you achieve that, giving you more control and peace of mind over your finances. It's about finding a solution that helps you feel more financially secure, which, frankly, is a pretty good outcome.

- Abbys House Worcester Ma

- Tom Deininger Sculptures

- Alycia Debnam Carey Fappening

- Matt Weber Photographer

- Angel Wiley Age

Logos of Multinational Companies: Multinational Company Logos

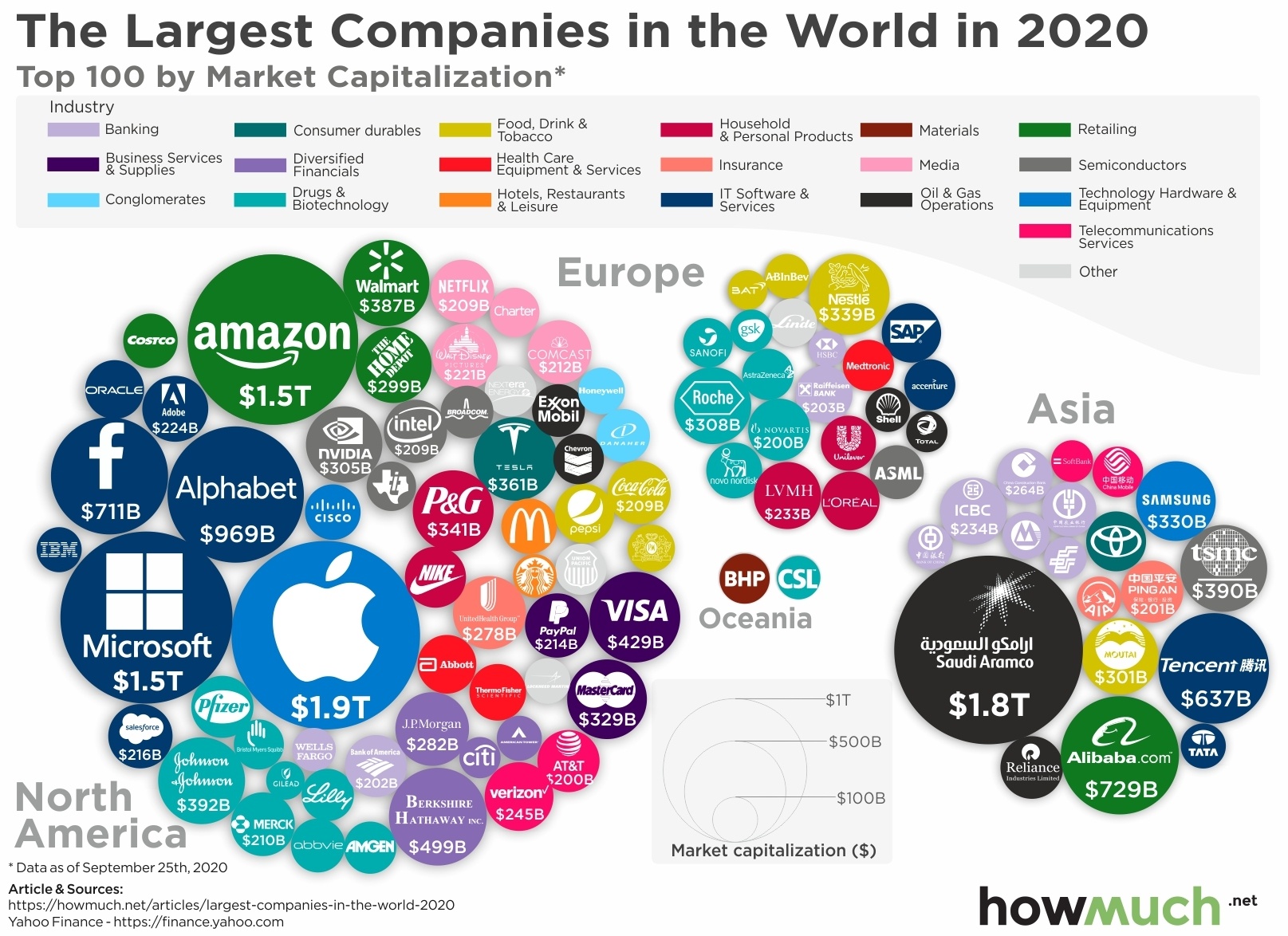

50 Largest Marketing Companies in the World - Leadership + Insights

The Biggest Corporations in the World - The Sounding Line